owner draw vs retained earnings

Business Owner Contribution and Drawing. There are two main ways to pay yourself.

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

Expanded Accounting Equation Definition

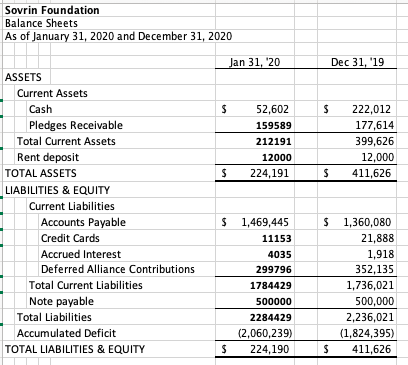

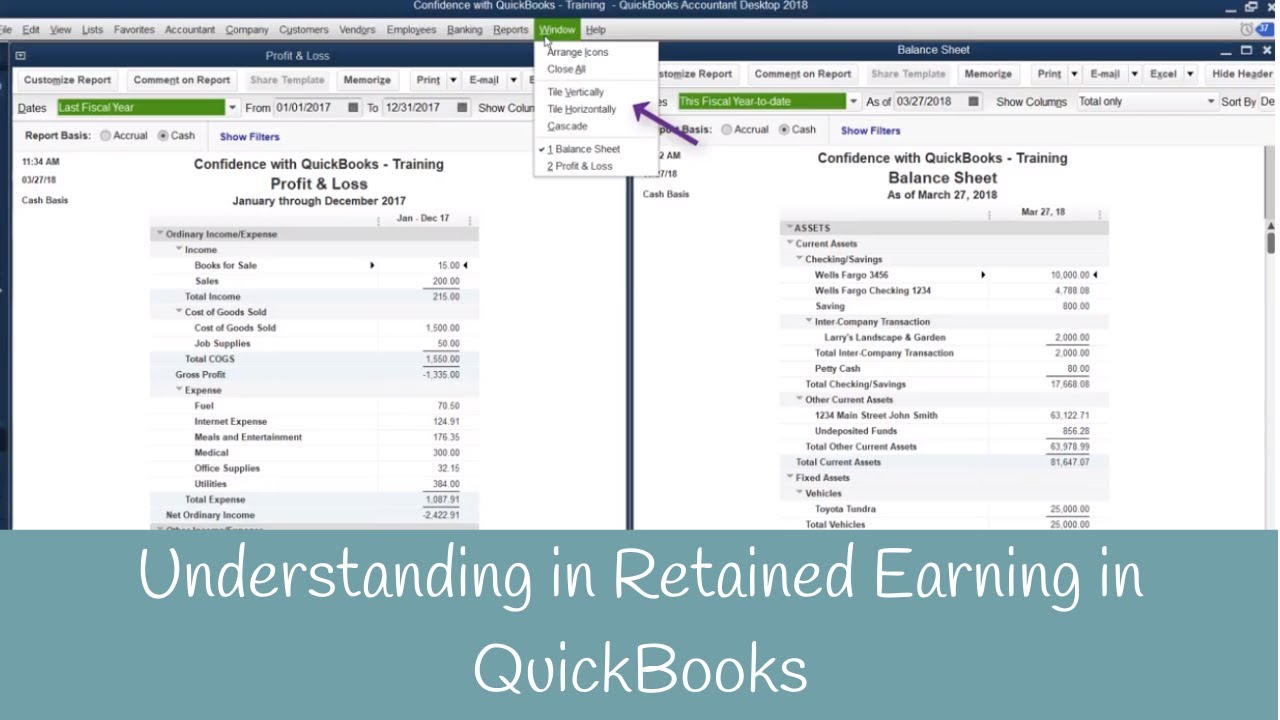

This account should be avoided posting any transactions to unless you are making prior year write offs or have received adjusting entries from your CPA.

. Draws can happen at regular intervals or when needed. Problems on Retained Earnings. With the draw method you can draw money from your business earning earnings as you see fit.

When I took a few college courses for introductory accounting which touched heavily on bookkeeping instead the texts would simply close out net income using a floating Income Summary account into Owners Contributions. My question is do I record paying myself from my projects as. Rather than having a regular recurring income this allows you to have greater flexibility and adjust how much money you get depending on how business is going.

I like NOT to see Retained Earnings but name that one Owner Equity. It otherwise gets its data from earnings on the profit and loss report. Accumulated profits general reserves and other reserves etc.

Answer 1 of 8. So if I understand correctly your contributiondrawing is negative. 10000 Net Profit.

Paid-in capital is a balance is the equity of a company that represents the par value of its issued shares. Retained earnings can also be accumulated losses of the. Owners draw is a temporary account which states the accumulated amounts an owner has withdrawn from the company presumably profits during a given year.

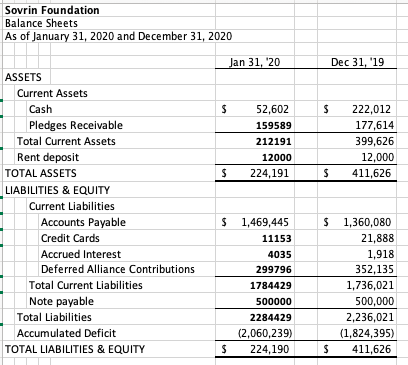

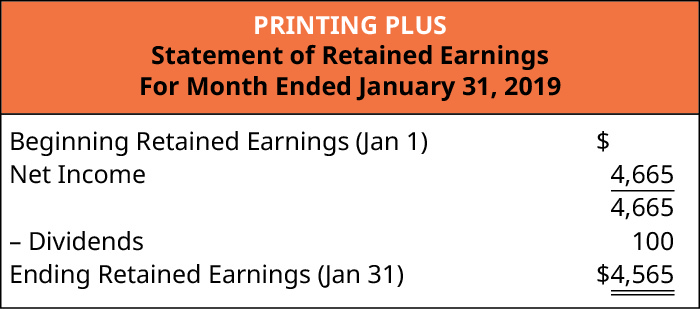

I have no start-up costs or initial investments instead I keep a part of the profit from the projects set aside to pay for the monthly maintenance costs. Beginning retained earnings net profit dividends current retained earnings. Retained earnings are profits or earnings of the business that have been kept for business use and not distributed to the owners or stockholders.

The formula for calculating retained earnings is. Every share issued by a company has a par value which denotes the value of the share set in the corporate charter. A corporation pays tax on annual net income profits minus deductions credits etc not retained earn.

The ideas of owners equity and retained earnings are utilized to speak to the ownership of a business and. When a C Corporation makes a profit it must pay corporate income tax on those profits. If the shareholder has negative stock basis in an S Corp then what are normally non-taxable distributions from the S.

You are correct about retained earnings. The draw method and the salary method. Owners equity is the amount that belongs to the owners of the business as shown on the capital side of the balance sheet and the examples include common stock and preferred stock retained earnings.

The business would record such overcompensations as directors or owners loans. If you are generating profits which I assume you are in order to continue taking draws then your retained earnings would be positive. Sole proprietorship or partnership owners withdraw assets from their business for personal use.

S Corp retained earnings are the profits made by the business that are retained and not distributed to the shareholders after they have paid taxes on such profits of the business. You cannot set up Subaccounts here. The owners dont pay taxes on the amounts they take out of their owners equity accounts.

Negative retained earnings in an S Corp usually but not always indicates that the shareholders have negative stock basis in the corporation. Updated on July 30 2020. Heres a high-level look at the difference between a salary and an owners draw or simply a draw.

I know that - at least from what Ive seen - most people will close income at year end into a Retained Earnings account or similar. This account is closed. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use.

If you net the accounts together you should get partner capital. My company is a sole member LLC. It creates a negative drawings impact on the business.

Answer 1 of 5. The business owner takes funds out of the business for personal use. Retained earnings is the amount of net profit or loss a company has accumulated since its inception.

In the following example we assume you have 10000 in net profit and a total of 2000 in dividends paid to shareholders. Retained Earnings This account is used to track all profits for prior years minus any distributions or dividends. Often directors and owners draw more funds than accumulated retained earnings hence the equity.

Owners Draws 50000 Total Closing Owners Equity. In other words retained earnings are accumulated earnings of a business after paying dividends or drawings to its stockholders or owners. Salary method vs.

That means the par value of a share does not change from one issue to another. The accounts you are referring to are cumulative in Wave. The business owner determines a set wage or amount of money for themselves and then cuts a.

Therefore the paid-in capital balance only. Its a way for them to pay themselves instead of taking a salary. Also known as the owners draw the draw method is when the sole proprietor or partner in a partnership takes company money for personal use.

The one that does NOT have a Register view no matter what it is named is Retained Earnings or Owner Equity that QB sill close the prior year into. Small business owners should learn about the circumstances under which they. As for Owner Equity open the chart of accounts and try to open each Equity account.

All business types except corporations pay taxes on the net income from the business as calculated on their business tax return. The owners loan will be adjusted against dividends or distributions when available. 1000 Beginning Retained Earnings.

How To Calculate Retained Earnings Formula Example And More

Negative Retained Earnings Accounting Services

Statement Of Retained Earnings Reveals Distribution Of Earnings Earnings Business Questions Business Case Template

Retained Earnings Account Is Missing

Negative Retained Earnings Accounting Services

Shareholders Equity Chapter Ppt Download

Debit And Credit Chart Accounting And Finance Accounting Career Accounting

Owners Equity Net Worth And Balance Sheet Book Value Explained

Prepare Financial Statements Using The Adjusted Trial Balance Principles Of Accounting Volume 1 Financial Accounting

Statement Of Retained Earnings Definition Formula Example Video Lesson Transcript Study Com

New Wave Difference Between Business Owner Contribution Drawing Vs Retained Earnings Wave Community

Retained Earnings Account Is Missing

Quickbooks Owner Draws Contributions Chart Of Accounts Quickbooks Accounting

T Account For Retained Earnings Youtube

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template

Accumulated Other Comprehensive Income And Treasury Stock Accountingcoach

:max_bytes(150000):strip_icc()/BOA-f8957c5ee9c14788b59a7e5edd802a7b.jpg)